Wednesday, December 21, 2005

Tuesday, December 06, 2005

Wired 12.10: The Long Tail

Wired 12.10: The Long Tail: "What percentage of the top 10,000 titles in any online media store (Netflix, iTunes, Amazon, or any other) will rent or sell at least once a month?'

Most people guess 20 percent, and for good reason: We've been trained to think that way. The 80-20 rule, also known as Pareto's principle (after Vilfredo Pareto, an Italian economist who devised the concept in 1906), is all around us. Only 20 percent of major studio films will be hits. Same for TV shows, games, and mass-market books - 20 percent all. The odds are even worse for major-label CDs, where fewer than 10 percent are profitable, according to the Recording Industry Association of America.

But the right answer, says Vann-Adib�, is 99 percent. There is demand for nearly every one of those top 10,000 tracks. He sees it in his own jukebox statistics; each month, thousands of people put in their dollars for songs that no traditional jukebox anywhere has ever carried."

Most people guess 20 percent, and for good reason: We've been trained to think that way. The 80-20 rule, also known as Pareto's principle (after Vilfredo Pareto, an Italian economist who devised the concept in 1906), is all around us. Only 20 percent of major studio films will be hits. Same for TV shows, games, and mass-market books - 20 percent all. The odds are even worse for major-label CDs, where fewer than 10 percent are profitable, according to the Recording Industry Association of America.

But the right answer, says Vann-Adib�, is 99 percent. There is demand for nearly every one of those top 10,000 tracks. He sees it in his own jukebox statistics; each month, thousands of people put in their dollars for songs that no traditional jukebox anywhere has ever carried."

Sunday, December 04, 2005

Fogel points to accelerating technological change

TCS: Tech Central Station - The Great Escape: "Nick Schulz: On the subject of techno-physio evolution, you say in the book that, 'this evolution is likely to accelerate in this century.' Why is that?

Robert Fogel: Well, first of all, our technology is accelerating.

Nick Schulz: How do you measure that? How do you know that it's accelerating?

Robert Fogel: Well in the book I give a diagram and show it visually. I have on the Y axis, the size of the population; and on the other axis, time. And I show the curve of population -- from about 1700 on, that curve becomes almost vertical on the scale that's shown in the book. And then along that scale, I put in scientific innovations.

One of the points I make is that it took 4000 years to go from the invention of the plow to figuring out how to hitch a plow up to a horse. And it took 65 years to go from the first flight in a heavier-than-air machine to landing a man on the moon. Not only did that happen in such a short period of time, but over a billion people all over the world watched it happen. So we had communications revolution in a very short period of time. I could work out a precise metric but it wouldn't mean much. It wouldn't give you more information than that diagram does.

"

Robert Fogel: Well, first of all, our technology is accelerating.

Nick Schulz: How do you measure that? How do you know that it's accelerating?

Robert Fogel: Well in the book I give a diagram and show it visually. I have on the Y axis, the size of the population; and on the other axis, time. And I show the curve of population -- from about 1700 on, that curve becomes almost vertical on the scale that's shown in the book. And then along that scale, I put in scientific innovations.

One of the points I make is that it took 4000 years to go from the invention of the plow to figuring out how to hitch a plow up to a horse. And it took 65 years to go from the first flight in a heavier-than-air machine to landing a man on the moon. Not only did that happen in such a short period of time, but over a billion people all over the world watched it happen. So we had communications revolution in a very short period of time. I could work out a precise metric but it wouldn't mean much. It wouldn't give you more information than that diagram does.

"

Tuesday, November 29, 2005

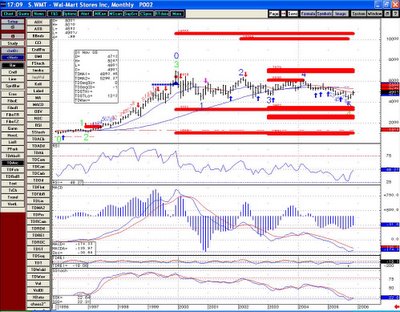

WMT Monthly

Wave 4 consolidation complete on a 9 not too far from fibo 34.6 projection? Target old highs and then 105.55? Rally from here will trigger MACD slingshot trend re-entry pattern. RSI rallied from oversold level to make a higher high. Slow stochastics turning higher (and bullish cross) from v oversold level last seen ahead of major advance starting 96.

WMT Daily

Took profits today from purchase in sep.

Price flip and break of MA on TDREI down following 13 sequential sell signal after price hit fibo target from TDWave projection. Bearish MACD cross following histogram divergence. RSI broken down.

Look to repurchase around 45.5 to 46.5 - old TDST levels from Sep and earlier this month. Trend-line support and 50% retracement of rally.

Bloomberg on Bridgewater

Bloomberg.com: Top Worldwide: "Nov. 29 (Bloomberg) -- One day in the early 1980s, a young trader named Ray Dalio placed a bet in the bond market. Then he reached for a yellow pad of paper.

Dalio, who'd been fired years earlier by Sanford Weill, the deal maker who would go on to build Citigroup Inc., jotted down the reason for his trade. Now 56, Dalio says he doesn't remember what he wrote that day -- maybe something about inflation. From then on, when Dalio made a trade, he'd grab his pad and start writing. ``Eventually, I had this pad of rules,'' he says.

That handwritten list of trading axioms became the blueprint for Bridgewater Associates Inc., the $141 billion money management firm that Dalio runs out of an anonymous, glass-and-stone building in the woods in Westport, Connecticut."

Dalio, who'd been fired years earlier by Sanford Weill, the deal maker who would go on to build Citigroup Inc., jotted down the reason for his trade. Now 56, Dalio says he doesn't remember what he wrote that day -- maybe something about inflation. From then on, when Dalio made a trade, he'd grab his pad and start writing. ``Eventually, I had this pad of rules,'' he says.

That handwritten list of trading axioms became the blueprint for Bridgewater Associates Inc., the $141 billion money management firm that Dalio runs out of an anonymous, glass-and-stone building in the woods in Westport, Connecticut."

Saturday, September 24, 2005

Dopamine and Investing

From John Mauldin's weekly newsletter

My friend Jim Williams of Williams Inference Center (http://www.williamsinference.com/) sent me the following note. Jim and his team read thousands of items a week, looking for the odd anomaly, trying to connect the dots to create patterns that are not easily observable. They do this for some of the largest corporations in the world. I found this piece so remarkable I re-print it in its entirety. I am not sure exactly what to make of it, other than it might explain the seeming American addiction to all sorts of manias and risk-taking activities (as well as other immigrant cultures).

"Mirapex was among the top-selling Parkinson's drugs last year, with more than $200 million in sales in the United States. The drug reduces tremors and the slow, stiff movements that are a hallmark of Parkinson's disease. Mirapex belongs to a class of drugs that mimic the effects of dopamine.

"A medical anomaly caught our attention: A recent Mayo Clinic study describes a compulsive gambling problem that developed among many Parkinson patients being treated with dopamine-enhancing medications. This is an unusual side effect.

"Also anomalous is the current U.S. obsession with the game of poker. Computer online gambling is booming, with poker sites alone expected to take in $2 billion this year. More than 50 million people describe themselves as poker players.

"As many as 10 million U.S. adults meet the "problem gambling" criteria, according to the National Council on problem gambling. Kids are hit even harder. The rate of problem gambling among underage players is between two and three times the rate for adults. Health officials want to know whether the damage can be curbed. What separates addictive gamblers from occasional ones? Another American oddity is obesity, which in turn may lead to diabetes.

"The medication for Parkinson's, the desire to gamble and the craving for excess food have one common denominator, dopamine.

"Dopamine is a pleasure-inducing brain chemical, a neurotransmitter that controls action. Dopamine is associated with addiction of all types. Recent studies have indicated that dopamine responds more to unpredictable rewards than to predictable ones. A part of the brain called the striatum where dopamine exists seems to care more about what it cannot predict. In a sense, dopamine produces a need for novelty.

"Dopamine has been associated with the novelty of drinking, gambling and other addictions, but it is also connected with curiosity, adventure, entrepreneurship and accomplishments. An experiment performed by Dr. Gregory Burns, author of a book on dopamine, Satisfaction, shows a positive side of dopamine.

"In this research probe by Dr. Burns, patients connected with MRI brain scanning were given a computer puzzle. When completed successfully, an award of $10 was produced. Under these conditions, the dopamine was high. There was uncertainty as to the outcome. Conversely, when the same patients were given $10, the level of dopamine was very low. Predictability was certain and effort was not required.

"Dopamine helps to produce results in an uncertain world.

"Dr. Peter C. Whybrow, a psychiatrist and author of American Mania postulates that dopamine has produced a manic America. He cites the words of satirist George Carlin, describing this land of puzzling contradictions, 'bigger houses but smaller families; more conveniences but less time; more knowledge but less judgment.' As a practicing psychologist, Dr. Whybrow finds this frenetic chase in America reminiscent of the manic-depression cycles in individual patients.

"Dr. Whybrow connects the excessive dopamine characteristics of America to migration. Approximately 2 percent of any population has enough dopamine to create the curios risk-taking necessary to leave the group. America basically is built through immigration. As a nation we have perhaps 50 percent with high dopamine characteristics. This drive has made America great.

"When explaining the difference between the American and European mind set, Dr. Whybrow cites and observation from Alexis de Tocqueville's famous 1835 treatise, Democracy in America. Tocqueville uses a merchant seaman as a metaphor. The European seaman is prudent when adventuring out to sea. When an unexpected event happens, he returns to port. The American, neglecting such precaution, braves these dangers. He sets sail while the storm is still rumbling. He spreads full sail to the wind. He repairs storm damage as he goes. The American is often shipwrecked, but no other sailor crosses the sea as fast as he does.

"The same mind-set difference between Europe and the United States is visible today. The Washington Post this June states, "In France, not a single enterprise founded in the past 40 years has managed to break into the ranks of the 25 biggest French companies. By comparison, 19 of today's largest U.S. companies didn't exist 4 decades ago. That's why France is looking to the United States for lessons."

"The dopamine drive exists in the United States, not France. Expect a series of American manic excesses and bankruptcies as well as successes."

It will be interesting to see if this can get a comment out of James Montier, whom I often quote as an expert on the psychology of investing. If he does, I will report back.

My friend Jim Williams of Williams Inference Center (http://www.williamsinference.com/) sent me the following note. Jim and his team read thousands of items a week, looking for the odd anomaly, trying to connect the dots to create patterns that are not easily observable. They do this for some of the largest corporations in the world. I found this piece so remarkable I re-print it in its entirety. I am not sure exactly what to make of it, other than it might explain the seeming American addiction to all sorts of manias and risk-taking activities (as well as other immigrant cultures).

"Mirapex was among the top-selling Parkinson's drugs last year, with more than $200 million in sales in the United States. The drug reduces tremors and the slow, stiff movements that are a hallmark of Parkinson's disease. Mirapex belongs to a class of drugs that mimic the effects of dopamine.

"A medical anomaly caught our attention: A recent Mayo Clinic study describes a compulsive gambling problem that developed among many Parkinson patients being treated with dopamine-enhancing medications. This is an unusual side effect.

"Also anomalous is the current U.S. obsession with the game of poker. Computer online gambling is booming, with poker sites alone expected to take in $2 billion this year. More than 50 million people describe themselves as poker players.

"As many as 10 million U.S. adults meet the "problem gambling" criteria, according to the National Council on problem gambling. Kids are hit even harder. The rate of problem gambling among underage players is between two and three times the rate for adults. Health officials want to know whether the damage can be curbed. What separates addictive gamblers from occasional ones? Another American oddity is obesity, which in turn may lead to diabetes.

"The medication for Parkinson's, the desire to gamble and the craving for excess food have one common denominator, dopamine.

"Dopamine is a pleasure-inducing brain chemical, a neurotransmitter that controls action. Dopamine is associated with addiction of all types. Recent studies have indicated that dopamine responds more to unpredictable rewards than to predictable ones. A part of the brain called the striatum where dopamine exists seems to care more about what it cannot predict. In a sense, dopamine produces a need for novelty.

"Dopamine has been associated with the novelty of drinking, gambling and other addictions, but it is also connected with curiosity, adventure, entrepreneurship and accomplishments. An experiment performed by Dr. Gregory Burns, author of a book on dopamine, Satisfaction, shows a positive side of dopamine.

"In this research probe by Dr. Burns, patients connected with MRI brain scanning were given a computer puzzle. When completed successfully, an award of $10 was produced. Under these conditions, the dopamine was high. There was uncertainty as to the outcome. Conversely, when the same patients were given $10, the level of dopamine was very low. Predictability was certain and effort was not required.

"Dopamine helps to produce results in an uncertain world.

"Dr. Peter C. Whybrow, a psychiatrist and author of American Mania postulates that dopamine has produced a manic America. He cites the words of satirist George Carlin, describing this land of puzzling contradictions, 'bigger houses but smaller families; more conveniences but less time; more knowledge but less judgment.' As a practicing psychologist, Dr. Whybrow finds this frenetic chase in America reminiscent of the manic-depression cycles in individual patients.

"Dr. Whybrow connects the excessive dopamine characteristics of America to migration. Approximately 2 percent of any population has enough dopamine to create the curios risk-taking necessary to leave the group. America basically is built through immigration. As a nation we have perhaps 50 percent with high dopamine characteristics. This drive has made America great.

"When explaining the difference between the American and European mind set, Dr. Whybrow cites and observation from Alexis de Tocqueville's famous 1835 treatise, Democracy in America. Tocqueville uses a merchant seaman as a metaphor. The European seaman is prudent when adventuring out to sea. When an unexpected event happens, he returns to port. The American, neglecting such precaution, braves these dangers. He sets sail while the storm is still rumbling. He spreads full sail to the wind. He repairs storm damage as he goes. The American is often shipwrecked, but no other sailor crosses the sea as fast as he does.

"The same mind-set difference between Europe and the United States is visible today. The Washington Post this June states, "In France, not a single enterprise founded in the past 40 years has managed to break into the ranks of the 25 biggest French companies. By comparison, 19 of today's largest U.S. companies didn't exist 4 decades ago. That's why France is looking to the United States for lessons."

"The dopamine drive exists in the United States, not France. Expect a series of American manic excesses and bankruptcies as well as successes."

It will be interesting to see if this can get a comment out of James Montier, whom I often quote as an expert on the psychology of investing. If he does, I will report back.

Neuroscience and Investing

Bloomberg and the New York Times recently picked up on a neuroecononmics paper on the ‘dark side of emotion’ paper that suggested investors with lesions to certain parts of their brain out-performed controls when playing certain kinds of high-expected value repeated risky games.

I think the papers below are interesting to investors from a more general perspective when it comes to improving the quality of our decision-making.

How Neuroscience can Improve Investing

Risk is Feelings

I think the papers below are interesting to investors from a more general perspective when it comes to improving the quality of our decision-making.

How Neuroscience can Improve Investing

Risk is Feelings

Friday, September 23, 2005

Interview with Newmont Mining President

Pierre Lassonde interview is worth a read on long term outlook for hard assets.

Friday, September 16, 2005

Jim Jubak: Rising Loan Provisioning May Tighten Credit in 2006

MSN Money - Do-nothing Fed is dangerously disengaged - Jubak's Journal: "

Talk is cheap, Mr. Greenspan.

But when it comes to bubbles and potential bubbles, that's all we get from the U.S. Federal Reserve. Greenspan and company can sure talk the talk. But walk the walk? Forget about it.

And I think that's going to get us -- and Alan Greenspan's successor as Federal Reserve chairman, come January -- in trouble. Again. In 2006, I'd estimate.

...

It's reasonable to conclude that with loan payments going up for some borrowers at least, the rate of loan delinquencies and defaults, now near historic lows, will start to move up, too.

It's in the banks' self-interest to look backward at declining loan-default rates and justify releasing more reserves. But the Federal Reserve is supposed to look forward and make sure that the financial system is ready for the turn in the cycle. Besides jawboning borrowers into borrowing less cheap money, the Federal Reserve could be pressuring banks to stop lowering reserves, at worst, and, at best, to start raising them. That would better prepare the banks for the turn in the credit cycle that continued short-term interest rate hikes from the Fed will create."

Talk is cheap, Mr. Greenspan.

But when it comes to bubbles and potential bubbles, that's all we get from the U.S. Federal Reserve. Greenspan and company can sure talk the talk. But walk the walk? Forget about it.

And I think that's going to get us -- and Alan Greenspan's successor as Federal Reserve chairman, come January -- in trouble. Again. In 2006, I'd estimate.

...

It's reasonable to conclude that with loan payments going up for some borrowers at least, the rate of loan delinquencies and defaults, now near historic lows, will start to move up, too.

It's in the banks' self-interest to look backward at declining loan-default rates and justify releasing more reserves. But the Federal Reserve is supposed to look forward and make sure that the financial system is ready for the turn in the cycle. Besides jawboning borrowers into borrowing less cheap money, the Federal Reserve could be pressuring banks to stop lowering reserves, at worst, and, at best, to start raising them. That would better prepare the banks for the turn in the credit cycle that continued short-term interest rate hikes from the Fed will create."

RBI bought $2.5bn USD in July

From Business-Standard

"Crisil Marketwire / Mumbai September 15, 2005

The Reserve Bank of India turned a net buyer of dollars in July, the first time this fiscal. The RBI bought $2.473 billion that month, according to the central bank’s bulletin released on Wednesday. Most of these purchases were made after the revaluation of the Chinese yuan was announced, currency dealers said. "

According to dealers, central banks across Asia had intervened to prevent a sharp appreciation in their currencies. South Korea, Malaysia, and Turkey also resorted to dollar purchases.

Back home, RBI’s dollar buys lifted the country’s foreign exchange reserves to $140.6 billion as on July 29, compared with $137.5 billion previous week.

Before July, the RBI had bought dollars in March to the tune of $6.03 billion. In June, they had sold $103.6 million.

"Crisil Marketwire / Mumbai September 15, 2005

The Reserve Bank of India turned a net buyer of dollars in July, the first time this fiscal. The RBI bought $2.473 billion that month, according to the central bank’s bulletin released on Wednesday. Most of these purchases were made after the revaluation of the Chinese yuan was announced, currency dealers said. "

According to dealers, central banks across Asia had intervened to prevent a sharp appreciation in their currencies. South Korea, Malaysia, and Turkey also resorted to dollar purchases.

Back home, RBI’s dollar buys lifted the country’s foreign exchange reserves to $140.6 billion as on July 29, compared with $137.5 billion previous week.

Before July, the RBI had bought dollars in March to the tune of $6.03 billion. In June, they had sold $103.6 million.

On the other hand, what's wrong with mild deflation?

George Selgin argues for a productivity norm where prices would fall in line with productivity. (One implication would be that there would be no need to worry about quality adjustments when determining monetary policy). This was favoured by Hayek and at one stage Keynes.

He also has some well-developed arguments for free banking (money and credit provided by private banks without the involvement of a central bank or other government institutions).

He also has some well-developed arguments for free banking (money and credit provided by private banks without the involvement of a central bank or other government institutions).

Should Fed target inflation or target projected forward price level?

macroblog: "When weighted by their expenditure shares in the market basket used to construct the CPI, the majority of price increases were far less than the average increase. Over 50 percent of the weighted price gains were less than 3 percent (when annualized). Nearly twenty percent actually fell.

You might say that this is all fine and good, but you happen to actually purchase the average market basket, and the price of that went up by a full 1/2 percent in one month. In other words, your cost of living rose, and stripping out those prices that increased a lot does not make you feel one bit better.

Hey -- that's a good point, and one that moves us in the direction of discussing what monetary policy ought to be trying to accomplish. Should we be content with managing the rate of inflation going forward? If so, the core measures seem exactly the thing to be focused on, as they likely provide a more accurate picture of the inflation trend. But there is no guarantee that such a let-bygones-be-bygones approach will undo the effects of large one-off increases in some price or subset of prices, even in the medium term. In other words, there is no guarantee that focusing on core inflation will stabilize the cost-of-living over horizons that people may care about."

You might say that this is all fine and good, but you happen to actually purchase the average market basket, and the price of that went up by a full 1/2 percent in one month. In other words, your cost of living rose, and stripping out those prices that increased a lot does not make you feel one bit better.

Hey -- that's a good point, and one that moves us in the direction of discussing what monetary policy ought to be trying to accomplish. Should we be content with managing the rate of inflation going forward? If so, the core measures seem exactly the thing to be focused on, as they likely provide a more accurate picture of the inflation trend. But there is no guarantee that such a let-bygones-be-bygones approach will undo the effects of large one-off increases in some price or subset of prices, even in the medium term. In other words, there is no guarantee that focusing on core inflation will stabilize the cost-of-living over horizons that people may care about."

Temperament as a source of alpha

Morningstar.com - Dig a Moat for Your Investments: "Envy, not greed, makes the world go round. And it's a serious problem. When we weigh its financial ill effects, it seems to us that envy may actually be the deadliest temperament-driven investment sin. We're frequently astounded that investors furiously scramble into the market's hottest sector, seemingly unable to miss out on the 'easy' profits others are making. But rushing into a popular investment category strikes us as odd. Why buy when prices are highest and margins of safety lowest? Yet the lure of the 1990s dot-com bubble, today's real estate boom, or any of history's famous bubbles amply demonstrate envy's powerful siren song. But if someone else gets rich a little faster than you, so what? Some investor, somewhere, will always have earned a higher return over any recent period. In our view, the demons of envy can be thwarted with a combination of awareness and a disciplined strategy of limiting investments to those that can be purchased with a margin of safety. Sure, there will always be a 'hot' market sector, but investing is a business in which the tortoise always wins in the end.

Temperament is merely a subset of the broader academic research into behavioral finance, and we've barely scratched the surface here. We urge serious investors to explore this field in much more depth than our space constraints permit. We'd recommend the final 'talk' in Poor Charlie's Almanack for those seeking an experienced practitioner's overview, and the works of academic heavyweights Danny Kahneman, the late Amos Tversky and Richard Thaler for those desirous of a more rigorous presentation."

Temperament is merely a subset of the broader academic research into behavioral finance, and we've barely scratched the surface here. We urge serious investors to explore this field in much more depth than our space constraints permit. We'd recommend the final 'talk' in Poor Charlie's Almanack for those seeking an experienced practitioner's overview, and the works of academic heavyweights Danny Kahneman, the late Amos Tversky and Richard Thaler for those desirous of a more rigorous presentation."

Fractal patterns cut stress, scientist says | The San Diego Union-Tribune

Fractal patterns cut stress, scientist says | The San Diego Union-Tribune: "Physicist Richard Taylor of the University of Oregon says such fractal patterns, found in nature and in art, seem to reduce stress. He is leading an international team of scientists that has found exposure to these patterns can lessen a person's stress levels by as much as 60 percent."